Our Investment Solutions – Tailored to Your Goals

Your finances are unique. Your investment portfolios should reflect this. We construct concentrated, high-conviction portfolios that reflect your unique financial circumstances and specific investment goals for growth and income, as well as your risk tolerances.

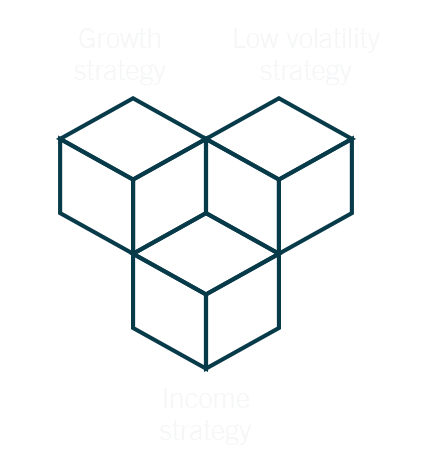

Our Three Building Blocks

We provide our clients with complete in-house investment solutions, not generic products. Client-specific portfolios are built by combining our three building blocks: our Income Strategy, our Growth Strategy and our Low Volatility Strategy. Each portfolio is concentrated, with a focus on publicly-traded North American companies. We offer tax-efficient personal investment accounts, RSPs, RRIFs, LLIFs, RDSPs, RESPs and TFSAs.

INCOME STRATEGY

Our Income Strategy aims to provide an attractive yield and sustainable income growth. Our experience and our disciplined investment process enables us to identify 20-40 financially strong companies with the potential for sustainable earnings growth to drive the steady growth of dividends. Dividend paying stocks tend to provide superior returns to the general stock market, while being less volatile. Bonds and preferred shares may occasionally be employed within this strategy.

GROWTH STRATEGY

Our Growth Strategy provides investors with the best prospects for long-term capital appreciation. This strategy will generally have a large representation of U.S. companies active in such established high-growth sectors as Consumer Products and Services, Healthcare, Information Technology, Environmental Technology and Specialty Industrials. We identify 20-40 established companies with key competitive advantages (financial, operational, managerial) active in business sectors that are enjoying secular growth. These firms usually exhibit superior revenue and earnings growth, but dividend yields are often low as management opts to re-invest in the rapidly growing business.

LOW VOLATILITY STRATEGY

Our Low Volatility Strategy seeks to offer superior risk-adjusted returns in a cost-effective manner. It is designed to serve either as a stand-alone solution for risk-averse clients, or as a stabilizer within more diversified portfolios. The Low Volatility Strategy comprises varying combinations of cash, exchange traded funds (‘ETFs’), and select dividend-paying stocks from our income and growth strategies.